Time for Atiur Rahman to deliver

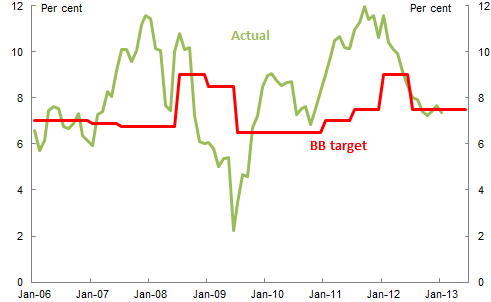

As far as I know, this blog is the only place that publicly criticised the appointment of Dr Atiur Rahman as the Governor of Bangladesh. How has he performed in the last few years as the central banker? Given the share market bubble and crash and several controversial developments — scams, ‘political’ banks, l’affaire Yunus — in the banking sector, it’s reasonably straighforward that he has failed in his task of maintaining financial stability. On the other hand, Bangladeshi economy has shown remarkable resilience — growth has been steady around the 6% mark despite shocks such as the share market crash or the fiscal strains related to the rental power plants. Inflation has been much higher than the Bank’s target picked up during most of the governor’s term, but has subsided recently to be within the Bank’s target (see the chart of inflation through the year, actual vs Bangladesh Bank target — source: CEIC Asia and BB).

So, on balance, a mixed record for the Governor so far. And over the next few months, his record can swing either way. Unfortunately, the latest monetary policy statement suggests that there is a high risk that my fears about him will yet come true.

This is what I said back in 2009.

There is a strong literature of political business cycle theory that shows that in all democracies, governments tend to spend beyond their means before election. How damaging this vote-buying depends on how strong the economic institutions are, with the central bank being the key institution. Suppose our Government were to embark on a pre election spending spree by 2013-14. What will happen if the Bangladesh Bank, in a misguided attempt at being ‘pro-poor’, accommodates that spending spree?

How does it hold up now?

Well, the government can’t go on a spending spree quite directly. The 2012-13 Budget was constrained by the conditionality of the IMF loan. Even if the government junks the IMF package (extremely unlikely, but I guess anything is possible these days) and plans a massive budget for 2013-14, the money will not get to the voters in time to make a difference in an election that is expected next winter. So fiscal expansion to be paid for money printing is not likely to be on the cards.

But Bangladesh Bank can print money anyway. And that’s what the new monetary policy statement says it will do.

The FY13H2 monetary policy stance is designed to ensure that the credit envelope is sufficient for productive investments to support the attainment of the government’s FY13 real GDP growth target while keeping it consistent with the targeted 7.5% average inflation rate for FY13. In view of the risks to output growth due to the uncertainties around the global economy, BB will reduce all repo rates by 50 basis points effective immediately. BB has also revised its monetary programwith a broad money growth target of 17.7% in June 2013 compared to the FY13H1 MPS target of 16.5%, and a new private sector growth envelope of 18.5% in June 2013 compared with the original program of 18%. BB has created further space in its monetary program in case there is greater lending appetite for productive purposes in H2FY13 and sufficient to accommodate even an optimistic scenario for FY13 output growth.

Let’s take it step by step.

The Bank says that economic growth faces risks coming from the global economy. But the risks around the global economy has, if anything, lessened in the last six months. Back in mid-2012, when the previous monetary policy statement was issued, uncertainties from Greece and other euro periphery were still acute, people were worrying about a hard landing in China, and the American economy faced uncertainties around the November’s election. Now the euro crisis seems to have abated, China has avoided a hard landing, and even the American politicians seem to be getting their act together.

This is not to suggest Bangladesh economy is going to grow by over 7% as was expected at Budget. The Bank expects FY13 growth to be around 6%. And that’s a pretty respectable pace. Rather, the point is that it’s not clear the economy is facing particularly more severe external headwinds now than it was six months ago.

So, why the monetary easing?

Look at the channel through which the extra money is supposed to hit the economy — bank loans to businesses. Who sit at the boards of state-owned banks? Who own all the new banks that have appeared in recent years?

One possible scenario — I would say the likely scenario — is that a lot of loans will be sanctioned and disbursed to ‘businessmen’ associated with the ruling party ahead of the election. Whoever participates in the election, and whenever it is held, it will involve a lot of money. And the money will be provided by the central bank.

The thing is, when too much money chases too few goods, when you have monetary easing in an economy running at trend pace and there is no excess capacity, you end up with inflation. That inflation could happen to goods prices. It could happen to asset prices. But however it happens, the result is not pretty.

Normally, like everyone else, I like to get things right. This, however, is an analysis I’ll love to get wrong. Will Governor Atiur Rahman deliver?

Comments Off on Time for Atiur Rahman to deliver